#subscriber identity module (sim)

Explore tagged Tumblr posts

Text

Did you Know? 📶 SIM का पूरा नाम Subscriber Identity Module होता है।

8 notes

·

View notes

Text

Some information technology acronyms

RAM = Random Access Memory

SIM = Subscriber Identity Module

SMS = Short Message Service

USB = Universal Serial Bus

WiFi = Wireless Fidelity

VLAN = Virtual Local Area Network

VPN = Virtual Private Network

HTTPS = HyperText Transfer Protocol Secure

WWW = World Wide Web

URL = Uniform Resource Locator

JPEG = Joint Photographic Experts Group

GIF = Graphics Interchange Format

PDF = Portable Document Format

CD = Compact Disc

DVD = Digital Video Disc

GPS = Global Positioning System

1 note

·

View note

Text

नवीन सिम खरेदी करण्यासाठी नवीन नियम लागू purchasing new SIM

purchasing new SIM आज आपल्या प्रत्येकाच्या जीवनात मोबाईल फोन अत्यंत महत्त्वाचा बनला आहे. आणि या मोबाईलचा जीव म्हणजे त्यातील ‘सिम कार्ड’. सिम कार्ड म्हणजेच Subscriber Identity Module, ज्यामुळे आपल्याला मोबाईल नेटवर्कशी जोडले जाते आणि आपण जगाशी संवाद साधू शकतो. आज आपण सिम कार्डशी संबंधित नवीन नियम, मर्यादा, प्रक्रिया आणि त्याचा वापर-दुरुपयोग याबद्दल सविस्तर माहिती घेऊया. सिम कार्डचे महत्त्व सिम…

0 notes

Text

Malaysia Subscriber Identity Module (SIM) Card Market size is expected to develop revenue and exponential market growth at a remarkable CAGR during the forecast period from 2024–2030.

0 notes

Text

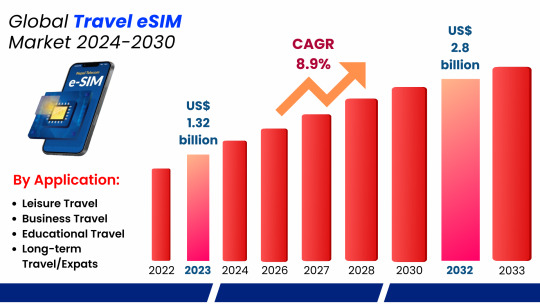

Travel eSIM Market Global Outlook and Forecast 2024-2030

Travel eSIM Market Size, Share 2025

Industry Overview:

A travel eSIM is an electronic SIM card designed for use during international travel. It allows you to connect to local mobile networks without the need for a physical SIM card.

The global Travel eSIM market has shown significant growth over the past few years, with the market valued at approximately US$ 1.32 billion in 2024. This growth is set to continue, with projections indicating that the market will reach a value of US$ 2.8 billion by 2032, reflecting a Compound Annual Growth Rate (CAGR) of 8.9% from 2024 to 2032. The expanding market is driven by several factors, including the rising demand for seamless connectivity, increasing adoption of IoT devices, and the growing number of eSIM-enabled devices.

The eSIM (Embedded Subscriber Identity Module) market is revolutionising mobile connectivity by substituting a more adaptable and digital SIM card for conventional physical SIM cards. This technology is especially helpful for travellers, IoT devices, and organisations that need multi-network connectivity because it enables users to swap carriers remotely without having to change SIM cards. The business is anticipated to grow quickly as eSIM adoption rises, propelled by smartphone manufacturers, IoT applications, and linked autos. Telecom companies, device producers, and software vendors are important participants in ensuring a safe and smooth digital experience. Although there are still issues with international standardisation and compatibility, the eSIM business has a lot of room to development.

Industry Analysis by Segments

Consumer eSim to hold the highest market share: by type

In terms of type the global travel eSim industry has been segmented as Consumer eSim and Machine to Machine eSim.

The consumer eSIM category holds a dominant market share of 60-65% due to its incorporation into popular consumer devices such as wearables, tablets, and smartphones. The integration of eSIM technology into flagship products by major tech companies including as Apple, Samsung, and Google has greatly increased customer adoption.

The flexibility and ease of use that eSIMs provide have contributed significantly to this expansion. For those who travel frequently or require access to different networks, eSIMs are perfect as they enable carrier switching without the need to physically replace the card, in contrast to standard SIM cards. Users no longer need to visit a physical store to complete the activation process because they can connect to a network digitally instantaneously. To further improve the user experience, eSIMs also support dual-SIM capabilities, which enables users to manage their personal and work numbers on the same device. Demand is anticipated to be driven by the increasing number of eSIM-compatible handsets on the market as well as rising consumer knowledge of its benefits. The use of eSIM technology will probably pick up speed as 5G networks spread and consumers demand more dependable, quicker connectivity, thereby consolidating its dominance in the consumer electronics industry.

Further, the Machine-to-Machine (M2M) eSIMs hold a 35-40% share of the market. These eSIMs are critical in the growing IoT sector, where they enable devices to communicate with each other without human intervention. Their use is expanding in industries such as automotive, logistics, and smart cities.

Smart phone to hold the highest market share: by Application

With 50–55% of the market share, smartphones are the most popular application category in the eSIM industry. The increasing number of smartphones with eSIM support as a result of big manufacturers like Apple, Google, and Samsung including the technology into their most recent models is what is driving this domination. The ease that eSIMs provide—especially for travelers—is a major factor propelling this market's expansion. Since eSIMs eliminate the need to swap out traditional SIM cards, they are the perfect option for frequent travellers who need to access various networks in different areas. Customers find it more appealing when they can handle various profiles or providers on a single device rather than having to carry around multiple SIM cards.

Regional Analysis:

In terms of region the global travel eSim has been segmented as North America, Europe, Asia Pacific, Middle East and Africa and South America.

Leading the global Travel eSIM market, Europe holds a 35-40% market share. The region's advanced mobile infrastructure, high adoption of eSIM-enabled devices, and favourable regulatory environment contribute to its dominance. The travel eSIM market in Europe is quickly becoming one of the most competitive and dynamic areas in the world. Europe is a centre for the adoption of cutting-edge digital solutions like eSIMs because of its high volume of international travel, advancements in technology, and supportive regulatory environments. More and more European travellers are searching for flexible, affordable mobile connectivity options that let them stay connected without having to deal with the inconveniences of traditional SIM cards or exorbitant roaming fees. The growing consumer demand for digital-first solutions and the wide availability of eSIM-compatible products, such as wearables and smartphones, are further factors driving the need for the eSIM era.

The increasing international travel across Europe further accelerating the travel eSim market in the region, In comparison with the previous year, there were more foreign visitors arriving in Europe in 2024. In 2024, the number of inbound arrivals was approximately 708 million, which was less than in 2019. This was despite a notable annual growth.

The European Travel Commission (ETC) has published its most recent "European Tourism Trends & Prospects," which states that as of 2024, the sector is stronger than ever. Overnight stays have climbed by 7%, while the number of foreign visitors has increased by 6% from 2019.

End Use Industry Impact Analysis:

The rapid expansion of the global tour eSIM market is being driven by the rise in global tour, the development of the mobile technology, and the increasing demand for digital solutions that provide seamless connectivity.

A primary factor propelling the growth of the Asia tour eSIM market is the substantial growth of both international and intraregional travels. It is anticipated that the number of international visitor arrivals (IVAs) to Asia Pacific will rise from 619 million in 2024 to 762 million in 2026, representing a recovery rate of 111.6% in comparison to the level of 2019. By 2026, visitor arrivals in Asia are expected to reach 564.0 million, followed by those in the Americas (167.7 million) and the Pacific (30.4 million).

Saudi Arabia alone welcomed over 100 million tourists, marking a 56% increase from 2019 and a 12% rise from 2022. Furthermore more the World Travel & Tourism Council (WTTC) reported that in 2024, tourism contributed AED 220 billion to the UAE’s GDP, a figure expected to increase to AED 236 billion in 2024

According to the World Travel & Tourism Council’s (WTTC) latest Economic Impact Report (EIR), reveals the North America Travel & Tourism sector is projected to grow at an average annual rate of 3.9% over the next decade, outstripping the 2% growth rate for the regional economy and reaching an impressive $3.1 trillion in 2032.

According to the international Trade Association, International travel plays a critical role in the US economy. Prior to the COVID-19 pandemic, in 2019, international visitors spent $233.5 billion experiencing the United States; injecting nearly $640 million a day into the U.S. economy

Competitive Analysis:

Some of the key Players operating within the industry includes:

Airalo

Holafly

MAYAMOBILE

BNESIM

Dent Wirelss

Keepgo

Nomad

Sim Options

Surfroam

Airhub

TravelSim

ETravelSIM

Ubigi

Numero eSIM

Total Market By Segment:

By Type:

Consumer eSIM

M2M eSIM (Machine to Machine)

By Application:

Leisure Travel

Business Travel

Educational Travel

Short-term/Temporary Stay

Long-term Travel/Expats

By Connectivity Type:

Standalone eSIM

eSIM with Roaming

Regional eSIM

Global eSIM

By End User:

Individuals

Enterprises

Telecom Operators

Travel Agencies

By Service Offerings

Data Services

Voice Services

SMS Services

Region Covered:

North America

EuropeAsia Pacific

Middle East and Africa

South Africa

Report Coverage:

Industry Trends

SWOT Analysis

PESTEL Analysis

Porter’s Five Forces Analysis

Market Competition by Manufacturers

Production by Region

Consumption by Region

Key Companies Profiled

Marketing Channel, Distributors and Customers

Market Dynamics

Production and Supply Forecast

Consumption and Demand Forecast

Research Findings and Conclusion

Combined Plans:

There are several distinct players in the highly competitive travel eSIM market, including tech companies, eSIM providers, and mobile network carriers. Important rivals are well-known telecom giants, which use their extensive international networks and strong brand names to sell travel eSIM plans directly to customers. Specialised eSIM providers like Airalo, GigSky, and Ubigi, on the other hand, are becoming more and more popular by providing flexible data packages and multi-country plans as well as affordable, customised travel eSIM solutions that are specifically designed for travellers from outside.

Tech companies like Apple and Google also influence the competitive landscape by integrating eSIM technology into their smartphones, enabling direct access to eSIM services through their app ecosystems. This has created opportunities for third-party eSIM service providers to partner with these tech firms, enhancing their global reach.

Key industry Trends:

Integration with IoT and Connected Device:

The Internet of Things (IoT) and linked devices are integrating eSIM generation, which is greatly expanding its use cases and marketability. As the Internet of Things continues to expand, eSIMs are finding their way into a wider range of electronics than just smartphones, such as wearable’s, connected motors, and smart home appliances. There are various benefits to this integration:

Wearables: Wearables, such as fitness trackers and smart watches, can maintain independent connectivity without relying on a paired phone because of eSIMs. Customers can now benefit from instantaneous message delivery, phone calls, and mobile data access via their wearable device, enhancing functionality and user experience.

Connected Cars: eSIMs in the automotive industry enable smooth connectivity for linked automobiles, providing features like real-time navigation, remote diagnostics, and infotainment services. The incorporation of eSIMs into cars facilitates updates via the air, enhances safety features, and offers improved connectivity for telematics and navigation applications.

Smart Home products: Home automation controllers, security systems, and thermostats are examples of smart home products that are incorporating the eSIM era. Through this connection, devices can communicate with one other and with customers anywhere in the world with consistent and dependable connectivity.

The expansion of eSIM technology into these diverse applications enhances its utility and opens up new market opportunities. For device manufacturers, integrating eSIMs simplifies design and manufacturing processes by eliminating the need for physical SIM card slots, leading to more compact and robust devices. Additionally, eSIMs support global connectivity, allowing devices to operate seamlessly across different regions without the need for multiple SIM cards.

Industry Driving Factor:

Rising Demand for Flexible and Convenient Connectivity Solutions:

Due to the increasing demand for seamless communication and connectivity when on the go, consumers are placing an increasing emphasis on the flexibility and convenience of their connectivity solutions. This trend is particularly noticeable among travellers, who are searching for solutions to make staying connected in unusual locales easier. These demands are met by ESIM technology, which gives traditional SIM cards a more adaptable and user-friendly option. eSIMs, as opposed to physical SIM cards, eliminate the need for physical swaps and let users activate and manage their mobile subscriptions online. With this method, travellers will no longer need to buy and insert several SIM cards or put up with the hassle of switching SIM cards when travelling to different countries. Alternatively, they could easily switch between plans or businesses right from their device, usually through a mobile app. One further factor driving the growing demand for eSIMs is their capacity to support many profiles on a single eSIM. This feature enables users to manage private plans for personal and business use or seamlessly transition between local and international plans. This flexibility now ensures continuous connectivity and helps users avoid paying exorbitant roaming fees in addition to improving comfort. The popularity of eSIM technology is continuing to rise as more customers look for solutions that fit their busy lifestyles and travel habits. This indicates a larger trend towards more flexible, virtual, and hassle-free connectivity options.

Industry Restraining Factor:

Device compatibility is one of the major challenges facing the eSIM business. Although the eSIM technology is increasingly being included into more modern wearable, and smartphones, many older or even less advanced devices do not support eSIM functionality. Due to the fact that a significant section of the customer base still uses devices that require physical SIM cards, this issue limits the market penetration of travel eSIMs. The switch to eSIMs isn't always possible for clients with mismatched equipment, which is likely to cause annoyance and reduce the potential customer base for travel eSIM providers. The challenge of device compatibility is made more difficult by the slow rate of update or modification of older devices. The adoption of eSIM generation may be slow in many places, especially where clients are more price-sensitive or where older devices are still in widespread use. Travel eSIM providers face a challenge as a result of this delayed adoption rate because they must serve a wide range of target customers with different levels of technological proficiency.

Report Scope:

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides break down details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by types, applications, Connectivity type, end use and Service Offerings. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.Report AttributesReport DetailsReport TitleTravel eSIM Market Global Outlook and Forecast 2024-2030Historical Year2018 to 2022 (Data from 2010 can be provided as per availability)Base Year2024Forecast Year2032Number of Pages107 PagesCustomization AvailableYes, the report can be customized as per your need.

1 note

·

View note

Link

0 notes

Text

0 notes

Text

0 notes

Text

換手機後注意事項

H:手機損壞,換手機如

臨大敵,令人神經緊繃,不可意料的因素常有,小心應對。一切只想恢復正常運作。手機瑕疵,只能送修,別無他法。(補記)20241209W1

1在FB問題尚可,轉移即可。

2在Line轉移没問題,但舊手機不能删,因為删了,新手機的Line也不見了。因使用同個安卓系統。有時舊手機因送修,而删,結果弄巧成拙,幸有手機店製備份留下,轉登入才存留。失而復得,虛驚一場。不熟不亂删,有些失去不見得能復得,慘劇常發生在無知覺之中「怎麼少了一個app」。送修,私人資料删了也可恢復,只能求神拜佛碰到有道德的維修員。手機一離手,任人宰割。賣舊手機看估價iphone12僅估7800元,但個人私密資料也將流失,得不償失。現代科技,删除的太易復原,有人建議砸碎,但未傷晶片也徒勞。不是重要人物,不太有名或不做壞事或可心不驚,但心存惡,檢調單位總是有辦法懲治名流惡人。

3事前準備功夫要做,密碼常忘要記在本子。在wordpress,重建,重入。X,重入,認證。We chat重入。其他,有問題重入。

4三星手機1條線說是面板問題,瑕疵修8750元。若一年保固應免費但要有保固證明,太舊手機到原廠才有材料。舊手機是情報人員最愛,只要工夫深,一切都能還原。

5原廠維修

三星維修服務中心-桃園民生,330桃園市桃園區民生路36號2樓。

雖營業到20:00,但送件最遲下午17:00,太遲雖收件也隔日修,人手不夠要休息。早上11:00開店,簡易損壞2小時可修復。

三星維修服務中心 - 台北西門,108台北市萬華區武昌街二段83-1號2樓。

三星維修服務中心 - 台北三創,100台北市中正區市民大道三段2號8樓。

三星台北微風南山維修服務中心,110台北市信義區松智路17號F115專櫃1樓。

新機可,但其他不定,有時送修,再送修。

新北市三峽區大學路92號及96號1F

6舊手機與新手機要有同樣app可聯結,舊手機才可備用,電信sim卡抽掉使用wifi。常保平常心,小心應對。

維基百科

Android([ˈænˌdrɔɪd]),是一個基於Linux核心與其他開源軟件的開放原始碼的行動作業系統,由Google成立的開放手機聯盟持續領導與開發。中文常用非官方音譯為「安卓」,[15][16][17][18][註 1]也有報道引述曾註冊過「安致」可能作為其中文商標。

SIM

用戶身份模塊(Subscriber Identity Module,SIM),通常稱為「SIM卡」或「電話卡」,是主要用於存儲用戶身份識別資料、簡訊數據和電話號碼的智能卡。

0 notes

Text

Understanding eSIM Technology: Pros and Cons

Understanding eSIM Technology: Pros and Cons The way we connect to mobile networks is evolving, and eSIM technology is at the forefront of this transformation. Embedded Subscriber Identity Modules, or eSIMs, have redefined how we use and manage mobile connectivity, eliminating the need for traditional SIM cards. In this article, we’ll delve into what eSIMs are, their advantages, disadvantages,…

0 notes

Text

BREAKING OVERNIGHT: GCash users hits Unauthorized Transactions amid security breach, leaving potential Nationwide Weekend Boycott and Protest looms in the main national HQ of the e-wallet fintech firm

(Written by Miko Kubota & Rhayniel Saldasal Calimpong / K5 TeleSerbisyo Patrol #5 news reporter and Station Manager & President of ONC; and Freelance News Writer, Online Media Reporter & News Presenter of OneNETnews)

TAGUIG, NATIONAL CAPITAL REGION -- Philippine electronic wallet fintech firm 'GCash' hits the unauthorized transactions, affecting some verified users as victims, who were losing significant amounts of 4, 5 or 6-digit money fund figures last Saturday early morning (November 9th, 2024 -- Taguig local time). The incident has raised concerns about the effectiveness of the SIM registration law and the security measures in place.

Reports say that the hackers eluded the Subscriber Identity Module (SIM) registration law under Republic Act #11934 by capitalizing on the reconciliation system vulnerabilities. Crossmatching and aligning transaction records in this said system, sometimes post temporary errors in its few to several verified accounts. Users, celebrities and even one Kapuso Ilonggo comedienne actress named 'Pokwang' (whose real name as 'Ms. Marietta Tan Subong'), reported unauthorized withdrawals without receiving any OTPs (One-Time Password) alerts, nor accidently click phishing or hijacking links. This unusual activity suggests that the hackers may have had inside knowledge or exploited a loophole in the system.

In Dumaguete City, our verified account numbers at GCash in both 'Globe Telecom' and 'DITO Telecommunity' were unaffected here. Still, frustrated users here have been trying and attempting to contact via GCash national hotline by dialing 2882, or filing tickets in the GCash app, with little success. There are apprehensions that the situation would ballooned up into a nationwide boycott and public protest at the main headquarters of GCash in Taguig City, National Capital Region, which may possibly happen on Monday (November 11th, 2024) with everything still left unresolved and leaving an image of the e-wallet company that discourages and permanently abandoning e-wallet users forever.

But in this condition, there is an exemption. E-wallet consumers can still cash-in as normal, making 'Quick Response' (QR) for money transfers, and transferring to other Philippine bank institutions that include 'Rizal Commercial Banking Corporation' (RCBC) and MayBank Philippines. These could be processed via 'InstaPay' and 'PESOnet', which may collect a small fee or at least free-of-charge with some limitations first per transaction. Cash withdrawals and Bancnet-supported automatic teller machine (ATM) debit card from both e-wallets and banks are all perfectly fine. In a sense as unfortunate, using e-wallets like GCash are not really necessary anymore, which may automatically broke the agreement of terms and conditions.

Effective immediately, GCash has temporarily disabled the "Send to Many" in-app feature due to cybersecurity concerns, in time for the online crisis of financial technology of e-wallet consumers. In a short press statement to OneNETnews, Vice President and Head of Corporate Communications named 'Ms. Gilda Patricia Maquilan' cited the assured users that the accounts that have been affected are safe, and that adjustments for the wallet are now currently ongoing for this weekend.

The affected users have been contacted by the fintech company, and it has advised them to change their Mobile Personal Identification Number (MPIN) and biometrics with your thumb-handed figures for better and layered security. This was limited to a small number of GCash-verified users, where money balances, regardless if they have 4, 5 or 6 digits were returned to their owners within a day or two.

The Department of Information and Communications Technology (DICT), Cybercrime Investigation and Coordination Center (CICC), Southern District Anti-Cybercrime Team (SDACT) and other government cybercrime agencies are investigating the incident. The National Privacy Commission (NPC) urgently tapped to address the unauthorized transactions.

The fintech firm that runs e-wallet company of GCash promised users of the platform not to being worried as their money was yet to be safe, and measures were being taken to correct the situation. The firm stands committed to fix the issue quickly and put in place measures for future incidents, just in time for the upcoming holiday season. Users are advised to track their accounts and report any unusual activities.

FILE STOCK PHOTO COURTESY for CONTEXT REPRESENTATION: Google Images and Nickelodeon Animation Studios via NTFX BACKGROUND PROVIDED BY: Tegna

SPECIAL THANKS to Jacques Reyes & Aubrey Manzano for contributing a news tip.

SOURCE: *https://philnews.ph/2024/11/09/gcash-releases-official-statement-amidst-unauthorized-transaction-concerns/ *https://philnews.ph/2024/11/09/gcash-trends-on-twitter-after-users-lose-money/ *https://unbox.ph/news/heres-the-biggest-loophole-of-the-sim-card-registration-law-irr/ *https://news.abs-cbn.com/business/2024/11/10/cicc-report-scams-to-government-instead-of-ranting-on-social-media-951 and *https://business.inquirer.net/489277/gcash-fixing-system-error-in-e-wallet

-- OneNETnews Online Publication Team

#breaking overnight#taguig#national capital region#NCR#GCash#unauthorized transaction#police report#boycott#protest#fyp#awareness#OneNETnews

0 notes

Text

नवीन सिम खरेदी करण्यासाठी नवीन नियम लागू purchasing new SIM

purchasing new SIM आज आपल्या प्रत्येकाच्या जीवनात मोबाईल फोन अत्यंत महत्त्वाचा बनला आहे. आणि या मोबाईलचा जीव म्हणजे त्यातील ‘सिम कार्ड’. सिम कार्ड म्हणजेच Subscriber Identity Module, ज्यामुळे आपल्याला मोबाईल नेटवर्कशी जोडले जाते आणि आपण जगाशी संवाद साधू शकतो. आज आपण सिम कार्डशी संबंधित नवीन नियम, मर्यादा, प्रक्रिया आणि त्याचा वापर-दुरुपयोग याबद्दल सविस्तर माहिती घेऊया. सिम कार्डचे महत्त्व सिम…

0 notes

Text

Smart Card Market : Analysis of Upcoming Trends and Current Growth

The Smart card market size is projected to reach USD 16.9 billion by 2026, from USD 13.9 billion in 2021; growing at a compound annual growth rate (CAGR) of 4.0% during the forecast period.

Major drivers for the growth of the smart card market are surged demand for contactless card (tap-and-pay) payments amid COVID-19, proliferation of smart cards in healthcare, transportation, and BFSI verticals; increased penetration of smart cards in access control and personal identification applications; and easy access to e-government services and risen demand for online shopping and banking.

Download PDF: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=285

By Vertical segment, the smart card market share for telecommunications segment held the largest share of the market A subscriber identity module (SIM) card is a type of microcontroller-based smart card used in mobile phones and other devices. A SIM identifies and authenticates a subscriber to a wireless cell phone network. The telecommunications segment accounted for the maximum share of 42% of the smart card market in 2020. Expanding global mobile network and improvements in its infrastructure are boosting the growth of the market. In addition, COVID-19 led to an increased demand for connectivity. The current crisis provided a push to the trend of digitalization of business and private communication with cellular technology, along with the generalization of digital conferences. Moreover, the penetration of high-end SIM card technologies, such as LTE, 5G, M2M, eSIM, and SWP, is expected to augment the market growth in the coming years.

By Interface, contactless segment of smart card market is projected to account for largest size of the market during the forecast period A contactless smart card includes an embedded smart card secure microcontroller or equivalent intelligence, internal memory, and a small antenna; it communicates with readers through a contactless radio frequency (RF) interface. Radio-frequency identification (RFID) or near-field communication (NFC) communication technologies are primarily used for contactless smart card applications. COVID-19 is positively impacting the contactless smart card industry growth as the World Health Organization (WHO) and governments across the world are advocating the use of contactless smart cards for various purposes to ensure social distancing to contain the spread of the virus. Contactless smart cards provide ease, speed, and convenience to users. The contactless interface has become highly relevant in the current COVID-19 situation, especially for payment applications, as it facilitates safe and secure transactions without physical contact.

By Region, smart card market in APAC estimated to account for the largest size of the market. Smart card market statistics in Asia Pacific (APAC) is the largest market during forecast period. The robust financial system that is being increasingly digitized and government agencies incorporating smart chip-based systems for better monitoring of processes are propelling several APAC countries to adopt smart card solutions owing to increasing demand, specifically in the transportation, BFSI, retail, government, and healthcare sectors. Smart cards are used to purchase tickets in metros, buses, and ferries, among others, in several countries in APAC. China is projected to witness the highest demand for smart cards in the region owing to a large consumer base and the presence of a number of smart card manufacturers.

Properly implemented smart cards in all sectors have proven highly effective in combating thefts and fraud. Government projects, such as the Aadhar card in India, drive the demand for smart cards for use in a number of sectors. Moreover, security concerns, particularly within the public sphere, are also expected to fuel the growth of the market in APAC.

Top Smart Card Companies - Key Market Players Thales Group (France), IDEMIA (France), Giesecke + Devrient GmBH (Germany), CPI Card Group (US), HID Global Corporation (US), Watchdata (China), Eastcompeace (China), Inteligensa (US), ABCorp (US), and CardLogix (US) are a few major smart card companies in the market.

0 notes

Text

Multi-Network SIMs vs. Traditional SIMs: What’s the Difference?

In the evolving landscape of mobile connectivity, SIM cards have played a crucial role in enabling communication and data transfer. As technology advances, so does the functionality of these tiny cards. Traditional SIM cards, which we have been using for decades, are now being complemented and, in some cases, replaced by multi-network SIMs. But what exactly sets these two apart? Let’s dive into the key differences between multi-network SIMs and traditional SIMs and explore how they impact your mobile experience.

Understanding Traditional SIMs

Traditional SIM cards, short for Subscriber Identity Module, are used to store the International Mobile Subscriber Identity (IMSI) and related key information used to authenticate and identify subscribers on mobile devices. These SIM cards are linked to a single mobile network operator (MNO), meaning your device connects to the network of the carrier that issued the SIM card.

Key Characteristics of Traditional SIMs:

Single Network Connectivity: Traditional SIM cards are locked to one network. If you’re in an area with poor coverage from your carrier, you’re out of luck.

Roaming Charges: When you travel internationally, traditional SIM cards typically incur roaming charges. These fees can be steep and vary depending on your carrier and destination.

Limited Flexibility: Switching networks often means physically changing SIM cards, which can be inconvenient and impractical.

Introducing Multi-Network SIMs

Multi-network SIMs are designed to address the limitations of traditional SIM cards by providing access to multiple networks. These SIM cards can automatically switch between different networks to ensure the best possible connectivity.

Key Characteristics of Multi-Network SIMs:

Multiple Network Access: Multi-network SIMs can connect to various networks, offering seamless coverage across different regions. This ensures you stay connected even if one network has poor coverage.

Cost Efficiency: By leveraging agreements with multiple network operators, multi-network SIMs can reduce or eliminate roaming charges. This is especially beneficial for frequent travelers who want to avoid hefty international fees.

Enhanced Reliability: The ability to switch between networks enhances reliability and reduces the chances of losing connectivity. This is crucial in remote or underserved areas where single-network coverage might be spotty.

Automatic Network Switching: Multi-network SIMs can dynamically select the best available network based on signal strength and quality, ensuring optimal performance without user intervention.

Comparing Traditional SIMs and Multi-Network SIMs

Coverage and Connectivity

Traditional SIMs: Limited to the coverage area of a single network provider. If you move out of this coverage area, your connectivity will suffer.

Multi-Network SIMs: Offers broader coverage by connecting to multiple networks. This ensures continuous connectivity even when one network is weak or unavailable.

Cost Implications

Traditional SIMs: Roaming charges can add up quickly when traveling internationally, making it an expensive option for globetrotters.

Multi-Network SIMs: Typically more cost-effective for international travel, as they can connect to local networks and avoid roaming fees.

Flexibility and Convenience

Traditional SIMs: Changing networks involves swapping out the SIM card, which can be inconvenient and time-consuming.

Multi-Network SIMs: No need to swap SIM cards. The device automatically connects to the best available network, providing hassle-free mobility.

Use Cases for Multi-Network SIMs

Frequent Travelers: For those who travel often, multi-network SIMs offer seamless connectivity without the need to switch SIM cards or worry about roaming charges.

Remote Work: Professionals working in remote or rural areas benefit from the enhanced coverage and reliability of multi-network SIMs.

IoT Devices: Internet of Things (IoT) devices, such as smart meters or connected vehicles, require constant connectivity, which multi-network SIMs can provide more reliably than traditional SIMs.

Conclusion

The evolution from traditional SIMs to multi-network SIMs marks a significant advancement in mobile connectivity. While traditional SIMs have served us well for many years, their limitations in terms of network dependency and roaming charges make them less suitable for today’s increasingly mobile and globalized world. Multi-network SIMs offer enhanced coverage, cost efficiency, and convenience, making them an ideal choice for travelers, remote workers, and IoT applications. As technology continues to advance, we can expect multi-network SIMs to become even more integral to our daily lives, ensuring we stay connected wherever we go.

0 notes

Text

Do you check SIM Owner Details with Live Finder Net?

A Subscriber Identity Module (SIM) card is a tiny chip used in mobile phones to store data about the subscriber. https://simcalldata.com/

#LiveFinderNet#Paksimdata#pakdatacf#livetracker#cnicinformationsystem#siminformationsystem#simownerdetails#siminformation#simdatabaseonline#simdatabase#paksimga

0 notes

Text

0 notes